Citation with persistent identifier:

Carrara, Aurélie.”Prevention or Cure? Tax Exemptions in a Warfare Context: Miletus and the Low Valley of the Maeander (early second century BCE).” CHS Research Bulletin 2, no. 2 (2014). http://nrs.harvard.edu/urn-3:hlnc.essay:CarraraA:Prevention_or_Cure_Tax_Exemptions.2014

http://youtu.be/XNdGL9EXf_0

1§1 Taxation in ancient Greece had various purposes. The easiest to identify is the acquisition of the revenue needed to pay for the public expenditures. Taxation was also used to meet other specific needs of the community. The second book of the Oikonomika attributed to “Aristotle” shows Greek states dealing with financial crises by a series of expedients or temporary measures. In the past most scholars believed that the Greek city-states dealt with financial problems in an ad hoc manner and did not formulate long-term financial policies. A close analysis of the sources however demonstrates that the Greek cities were also able to provide answers to more complex problems and to adapt the solutions they chose to different goals. For instance, the Greek city-states devised strategies to overcome perennial shortages of certain types of commodities or to encourage the growth of specific economic activities. In order to do this, they used the tax exemption (ateleia), among other tools.[1] A warfare context is a good instance to tackle these economic issues.

1§2 The evidence for the history of Miletus and its neighbors in the early second century BCE is of particular interest because it deals with both kinds of strategies. Moreover, it shows a graduation in dealing with a temporary crisis. Finally the city set up permanent tax incentives for specific economic reasons such as attracting a specific product to its market. This kind of evidence leads us to conclude that ancient Greek states could use taxation to serve their economic interests, not just the needs of public finance. The main topics I discuss in this paper are the taxation of trade and some aspects of the way the system of taxation functioned in the Greek cities. The documents are not presenting in the chronological order but, regarding the economic perspective, from the shortest to the longest one.

Context and chronology

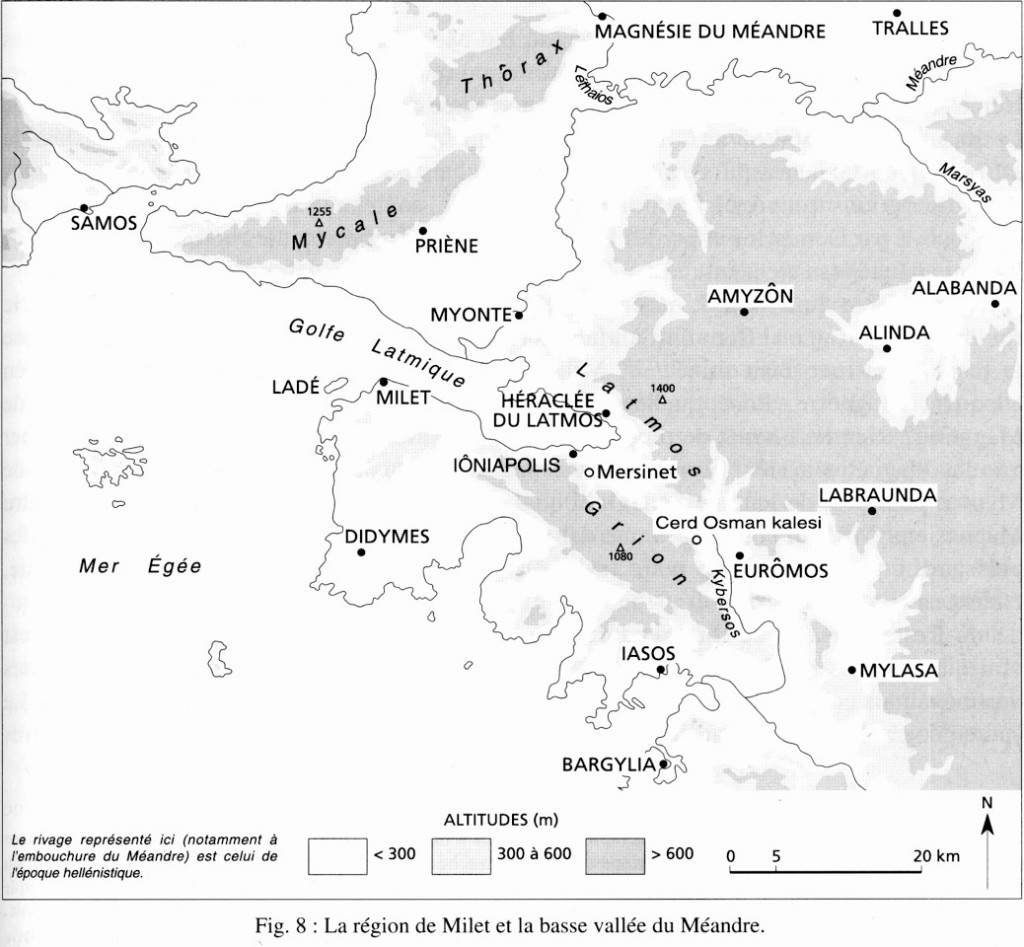

2§1 In the early second century BCE, the lower Maeander valley suffered from territorial conflicts. The city of Miletus attempted to increase its territorial control at the expense of its neighbors, Heraclea by Latmus and Magnesia on the Maeander.[2] The conflicts concerned the area of the Latmic gulf. One of the territories at stake was the ancient city of Myous and its sanctuary of Apollo Terbintheus, which Miletus controlled from the third century BCE.[3] Miletus lost the sanctuary when Philip V granted it to Magnesia after the battle of Lade (201 BCE). The three texts concerning these events were discovered in excavations at the Delphinion near Miletus. They consist of a treaty of peace with Magnesia, a treaty of alliance and isopoliteia with Heraclea, and a sympoliteia with the community of Pidasa, on the Mount Grion.[4]

N.B. Cerd Osman Kalesi is the proposed location for Pidasa.

2§2 The dating of the texts is problematic because the list of the eponymous magistrates of Miletus during this period is incomplete. The most serious debate concerns the dating of the convention between Miletus and Magnesia, and their respective allies, Heraclea and Priene. Initially it was dated in 196 BCE mainly because of the absence of Roman intervention in the negotiations. Wörrle has confirmed this dating in his study of the chronology of the Milesian stephanephoroi.[5] However, Errington pointed out that after 188 BCE many conflicts and disputes were solved without the arbitration of Rome. He was also puzzled by the absence of Antiochus III in this text—notwithstanding this being his area of influence—and by the relevance of Miletus waging war with the proximity of the Seleucid king.[6] He finally assumed that the alliance treaty with Heraclea—dated maybe in 185/4 BCE[7]—most likely took place prior to the peace with Magnesia. Accordingly, he dated the convention of Miletus and Magnesia between 184 and 180. Even though there seems to be a consensus about this dating, Wörrle has recently reaffirmed his hypothesis for a dating in ca. 197 or 196 BCE [8] considering that there is no convincing argument against an earlier dating.[9] The chronology of the sympoliteia treaty between Miletus and Pidasa could also be confirmed by the two former texts. It is highly possible that it was decided upon by the Pidasians. Gauthier framed the following attractive hypothesis:[10] the Pidasians were threatened and looked for the protection of their Milesian neighbor. He proposed that Heraclea was the threatening city[11] and he drew a parallel with the conflict between Miletus and Heraclea concerning the Latmic gulf. Indeed, as for the Milesians,[12] the Romans returned to the Pidasians a part of their territory in 188 BCE, some territories that the Heracleots would have claimed later. This would have led to the coming together of the two threatened cities. The sympoliteia could then date from 188/7 or 187/6.

2§3 To summarize the chronology proposed for these three texts, the Pidasians were first integrated in the Milesian community, maybe around 188/7 or 187/6 BCE. Together they were probably fighting Heraclea in the following years, the conflict ending perhaps in 185/4 BCE with an alliance treaty. It could have been followed by the war against Magnesia, possibly between 184–180 BCE. Consequently, after the peace of Apamea that ended the Seleucid hegemony in the area, Miletus appeared to aim at enlarging its influence in its immediate neighborhood—a policy that Herrmann calls “expansionist”—while observing the new Rhodian supremacy established in the area.[13] In this military context, the cities had to face temporary crises and to enable their inhabitants to return to a regular economic situation. Because of the endemic state of war in the Hellenistic period, it was the first reason of economic destabilization.

The convention between Magnesia and Miletus (184–180? BCE)[14]

3§1 The convention (sunthêkai) established the border between Magnesia and Miletus on the Hybandus river (lines 27–38), whose location has not yet been determined with certainty.[15] It is possible that the river was already the border between the two cities before the war. But the terms of the treaty may have compelled Miletus to abandon some territories north of the river.[16] What can be said with certainty is that the new chôra of Magnesia extended to the north of the river, and the one of Miletus to the south. The cities agreed not to seize their neighbor’s territory (lines 38–47). The agreement concerned their respective allies, Heraclea and Priene (lines 58–59).

3§2 Among other measures,[17] they decided to grant some tax exemptions in order to facilitate the return of the goods moved during the conflicts:

(lines 50–53) ἐὰν δέ̣ τινα τῶν̣ ἀ̣π[εσ]κ̣ε̣υα̣σμένων ἢ μεθεσταμένω[ν] | ἐ̣ν τῶι συνστάντι πολέμωι βούλωνται μετάγειν ἢ Μάγνητες διὰ τῆς Μ̣[ι]|λ̣ησίων χώρας ἢ Μιλήσιοι διὰ τῆς Μαγνήτων, εἶναι αὐτοὺς ἀτελεῖς, ἐ|ὰ̣μ μετάγωσιν μετὰ μῆνας δύο ἀπὸ τοῦ χρόνου τοῦ τῆς συνθήκη̣[ς] ·

And if a Magnesian, through the territory of the Milesians, or a Milesian, through the territory of the Magnesians, wishes to convey something among the (goods) that have been carried off or removed during a recent war, they are to be free from tax if they convey (it) in two months from the time [i.e. the signature] of the treaty;

3§3 In a second time the cities, forecasting a new war and potential pillaging or seizures, facilitated the same possibility of moving goods in more secure places:

(lines 54–58) ὅ̣σ̣α δ’ ἂν κατὰ πόλεμον ἀποσκευάζωνται ἢ μεθιστάνωσιν ἢ Μάγνητ[ες] || εἰς τὴν Μιλησίων ἢ Μιλήσιοι εἰς τὴν Μαγνήτων ἢ οἱ κατοικοῦντες ἐν [ἑ|κ]ατέ[ρ]ᾳ̣ τῶν πόλεων ἢ διάγωσι̣ν̣ [ἵν]α̣ ἀποκαθιστάνωσιν εἰς τὴν ἰδίαν, ε[ἶ|ν]α̣[ι] ταῦτα ἀτελῆ καὶ προνοεῖν [ὑ]πὲρ̣ α̣ὐτῶν τοὺς ἄρχοντας τοὺς ἐν ἑκα|[τέ]ρ̣αι τῶν πόλεων ·

And the goods that, during a war, would carry off or remove, either Magnesians toward (the territory) of the Milesians, or Milesians toward (the territory) of the Magnesians, or the inhabitants in each of the cities, or would carry across (the territory), in order to transport (them) to their own estate, those goods are to be free from tax, and the magistrates in each of the cities have to take care about it.

3§4 Chaniotis has described well the dangers that a territory could face in the event of an invasion: “Enemies destroyed crops, burned fields and farms, stole the gathered surplus, took fodder for their horses and draught animals. […] Manpower was lost, the invasion disrupted regular cultivation, slaves found an opportunity to run away, and shepherds sought refuge with their livestock in the territory of a friendly neighbour.”[18] The conflict between Magnesia and Miletus was brief, and the two cities may not have faced such a great threat. Nonetheless, some inhabitants had to move goods, probably in an allied territory or maybe elsewhere.

3§5 Two kinds of tax were at stake in those clauses: the customs duties and the transit tax. The customs duties were taxes on import (eisagôgê) or export (exagôgê), levied on goods entering or leaving a territory. The most common form was the ad valorem tax, the rate of which was a percentage levied on the commercial value of the goods taxed. The most attested rate was a pentêkostê, a tax of a fiftieth.[19] Unfortunately, we do not know either the rate or the way the customs were assessed in the cities mentioned in our text.[20] But we do have other evidence for their existence. In a decree dated from the Hellenistic period, Magnesia granted Polemarchos of Samos an “exemption on all taxes on what he imports, exports or carries across for his own estate.”[21] Consequently a transit tax (diagôgion, paragôgion) was assessed along with the regular customs duty in Magnesia.[22] Our knowledge about taxation on the transit trade is scant, although we have several attestations.[23] The evidence, as in this example, allows us to assume that it was a specific tax, maybe with a specific rate or rather a flat-rate tax. Logically, it should be more favorable than to pay the customs duty at the entrance and exit of the territory. A working hypothesis would be that the transit tax was a passage fee, close to the user fees that one could pay to use, for instance, the facilities in the port or to the tolls levied at some key points of the territory (gate, bridges…). But the tolls are also poorly documented.[24]

3§6 In the convention, the first clause dealt with the past war and apparently granted an exemption only on the transit tax applying to the goods that would be carried across (metagein […] dia) the territory of the ancient opposing city. It was definitely a temporary measure, because it should apply only to the two months after the treaty had been signed. The aim of the city was clearly to help its inhabitants to recover after a war episode and to return their economic affairs to normal. It seems surprising though that the customs were not concerned similarly. Indeed, the conflict ended with fixing the border, which was maybe moved from its previous location. If it is the case, some goods could have ended on the other side of the new border. Consequently, and also considering the second clause, I claim a broader meaning for the wording metagein dia, including the customs duties.

3§7 The second clause seems repetitive, but dealt first with a forthcoming war and then with a wide grant. Indeed, it concerned again the transit tax (diagôgein) but also clearly the import tax (eis tên…) in the allied territory. Logically, it should also imply the export tax, for the return of the goods once the war would be over. Then it applied to three categories of people, the citizens of Miletus (Milêsioi) and Magnesia (Magnêtes), but also the inhabitants (katoikountes) of the two cities. It is the only time that the foreigners living in the cities appear in the text. But we cannot really conclude that they were excluded from the grant in the first clause, because it does not seem reasonable. If they were excluded, it is difficult to explain why. Another precision is added in this the second clause. The goods concerned should be transported “to their own estate” (ina apokathistanôsin eis tên idian). This category of goods is known in other texts and appears to relate to goods used for personal use, that is, not for trade. Once again, the city’s aim was to protect the regular economic state of the community and to prevent the traders from benefiting as a result of the grant. This passage raises the following question: did this restriction apply to all taxes or only to the transit one? In my view the first possibility would have made more sense, but we cannot exclude the second hypothesis, especially since the subordinate clause follows the verb diagôgein, which is highly emphasized because it is separated from the other verbs of the sentence. In any case, in this second clause, the author of the decree seems to want to be accurate, not forgetting a possible case.

3§8 Finally, nothing is said in these clauses about the taxes potentially paid when crossing an allied territory, Priene for Magnesia and Heraclea for Miletus. Yet, insofar as the peace treaty applied to them, we could infer that the exemption was applied to their taxes too. We find the same kind of clause in the alliance treaty between Miletus and Heraclea.

The alliance treaty between Miletus and Heraclea (185/4? BCE)[25]

4§1 Here again, the contested territories were around Myous and Ioniapolis, around the Latmic gulf (lines 78–86).[26] But here, the border was set up in a mountainous area belonging to the territory of the former city Myous and the sacred land of Apollo Terbintheus. The Heracleots claimed it to be part of the Kisaris. The contracting cities granted each other isopoliteia,[27] reaffirming their loyalty to the Rhodian alliance (lines 34–36) and committed themselves to a defensive alliance (lines 39–42). The cities set up measures to bring back normal living conditions[28] and then decided some favorable tax dispositions. The first disposition, as in the treaty with Magnesia, seeks to prevent the repercussions of a forthcoming war:

(lines 67–73) ἐὰν δέ τις Μιλησίων ἢ τῶν κατοικούντων ἐμ Μιλήτωι βούληται διὰ | πόλεμον ἀποσκευάζεσθαί τι τῶν ἰδίων ἢ μεθιστάνειν εἰς τὴν Ἡρακλεωτῶν πόλιν ἢ χώ|ραν ἢ διάγειν διὰ τῆς πόλεως ἢ τῆς χώρας τῆς Ἡρακλεωτῶν, εἶναι αὐτὸν ἀτελῆ πάντων || τῶν προειρημένων. ὁμοίως δὲ καί, ἐάν τις Ἡρακλεωτῶν̣ ἢ τῶν κατοικούντων ἐν Ἡρακλείαι | προαιρῆται διὰ πόλεμον ἀποσκευάζεσθαί τι τῶν ἰδίων ἢ μεθιστάνειν εἰς τὴν πόλιν τὴν Μιλη|σίων ἢ χώραν ἢ διάγειν διὰ τῆς πόλεως ἢ τῆς χώρας τῆς Μιλησίων, εἶναι αὐτὸν ἀτελῆ.

If a Milesian or an inhabitant of Miletus wishes, on account of a war, to carry off one of his personal goods or remove (it) to the city of the Heracleots or their territory, or to carry (it) across the city or the territory of the Heracleots, he is to be free from all the taxes mentioned beforehand. And in a same way, if a Heracleot or an inhabitant of Heraclea prefers, on account of a war, to carry off one of his personal goods or remove (it) to the city of the Milesians or their territory, or carry (it) across the city or the territory of the Milesians, he is to be free from tax.

4§2 As in the second clause of the treaty with Magnesia, the agreement granted an exemption from tax on imported (and probably exported) goods in the allied territory and also from the transit tax. The goods concerned should be idia as well, which means not for a commercial purpose, but for a personal use. The cities here again wanted to provide their inhabitants with the means to recover from a temporary crisis. The recipients were clearly detailed, inasmuch as the citizens and the inhabitants (katoikountes) are mentioned, as well as the space concerned, the polis and the chôra.

4§3 The second clause did not relate to a future war, but to a permanent decision:

(lines 72–86) κατὰ | ταὐτὰ καὶ ἐάν τινες τῶν ἐκτημένων ἐν τῆι Μιλησίων χώραι ἢ γεωργούντων διάγωσιν κτήνη̣ | ἐκ̣ τῆς Μιλησίων χώρας εἰς τὴν Μιλησίαν διὰ τῆς Ἡρακ̣λεωτῶν χώρας ἢ πόλεως, ὡς μὲν Μι||λήσιοι ἄγουσιν, ἀπὸ στεφανηφόρου Μενάνδρου καὶ μηνὸς Μεταγειτνιῶνος, ὡς δὲ Ἡρακλε|ῶται ἄγουσιν, ἀπὸ στεφανηφόρου τοῦ μετὰ θεὸν τεσσερεσκαιδέκατον τὸν μετὰ Δημήτρι̣|ον, εἶναι αυτοὺς ἀτελεῖς πιστωσαμένους ὅρκωι, διότι ἐπὶ κτήσει ποιοῦνται τὴν διαγωγή[ν].

And likewise, if some of the owners or the farmers in the territory of the Milesians carry herds from the Milesian territory to the Milesian (territory), through the territory or the city of the Heracleots, from the stephanephorate of Menandros and the month of Metageitnion according to the Milesian calendar on the one hand, from the stephanephorate following the fourteenth (office) of the god after (the one of) Demetrios according to the calendar of the Heracleots on the other hand, they are to be free from tax after having given a pledge by oath that they do this carrying across for their ownership.

4§4 This decision affected the circulation of the cattle. The livestock farming was an important economic activity in the region, especially the production of the famous Milesian wool.[29] Facilitating the pastoral activity was therefore an important concern. Milesian herds could be carried across the Heracleot territory free from the transit tax, providing that the farmers committed to do this carrying epi ktesei, so again for a personal use. Hence once more, it was not about trading purposes, but rather about enhancing the livestock farming activity. This obligation was strict, insofar as the farmers had to give a pledge by oath. Chandezon saw in this oath an official statement of the number and the nature of the cattle made by the Milesians at the entrance of the territory of the Heracleots.[30] This exemption was not mutual and is explained by the shape of the Milesian territory. Indeed, Miletus possessed the ancient territory of Myous, which was a place of humid meadows in the low Maeander, therefore apt for livestock. The only way to reach it from the pasturelands in the Mount Grion was to take the maritime road reaching Myous via the ferryboat from the Ioniapolis harbor.[31] But this maritime road was expensive, because one had to pay a fee to the farmers in charge of the ferryboat.[32] By allowing the Milesians to traverse their territory free from tax, the Heracleots offered them a longer, but a cheaper way to reach Myous by land.[33] This concession affected at the same time the landowners (tines tôn ektêmenôn) and the farmers (geôrgountes). Referring to a study on the wording enktêmenoi in Delos and Rhenaea,[34] Migeotte concludes that this clause concerned only the foreigners possessing lands and those who practiced agriculture, excluding maybe those specialized in livestock farming.[35] This interpretation encounters two objections. The first one is to understand why the Milesian citizens would not be affected by the exemption. One could assume that they benefited already from this exemption in a former agreement. This is a possible hypothesis, even though in such a case we would expect a phrase like “as the other Milesians.”[36] The second issue is to explain why the farmers specialized in livestock would be excluded from the exemption. Indeed, the aim of the measure was to facilitate the moving of livestock through the Milesian territory. How could we explain the fact that a part of the Milesian producers were excluded from it? Actually, the study of Chandezon on livestock shows that agricultural activity was not specialized in the ancient world, which means that the modern division between agriculture and livestock is not relevant here.[37] Consequently, I claim that the clause concerned anyone involved in one way or another with livestock. It refers to the owners of lands in Miletus (tines tôn ektêmenôn) on the one hand, and to those who rented land (geôrgountes) on the other hand, either because they were foreigners without the right of possession (enktesis) or because they were too poor to acquire one. The decision was permanent, but it was put into action probably in the beginning of the next year.[38] In doing so, Miletus did not try to prevent a future war, but took care of improving the conditions of an important economic activity for the inhabitants. Of course, we should keep in mind that the military situation would have played a role in this decision and that it was aimed at non-trading purposes. Consequently, its economic effects should have been limited to the improvement of the daily life of the inhabitants of Miletus. But in so far as the measure was permanent and went beyond recovering from the war, it can be considered to my mind as an economic choice in a more long-term view. There is a similar clause in the agreement with Pidasa.

The sympoliteia with Pidasa (188/7 or 187/6)[39]

5§1 Following Rehm, this text was considered for a long time as an “additional act” added to a Milesian decree regulating the sympoliteia.[40] But Gauthier has convincingly demonstrated that this text was the actual sympoliteia agreement.[41] Several clues led him to assume that Pidasa was probably integrated in the Milesian territory as a tribe or a deme, keeping some elements of its past autonomy.[42] Most of the Pidasians seem to have remained in their ancestral land to live on and from their territory. This agreement also took place in a threatening context. Miletus committed to protect the Pidasian territory: in restoring the fortification and setting up a garrison (lines 15–18), as well as in acting as an advocate in the case where the territory recently given back to Pidasa would have been contested (lines 37–39).[43]

5§2 In this case, however, the decisions about taxes were not taken in anticipation of a new war, but in order to integrate the new citizens into the Milesian community. Along with the citizenship (lines 10–14), the Milesians granted the Pidasians fiscal privileges. Gauthier suggests that the aim may have been to help them to recover from pillaging and destruction on their territory.[44] Migeotte considers also the possibility that the tax burden was higher in the Milesian system than in the Pidasian one. In this way, the tax reductions would have offered an easier transition for the new citizens, allowing them to become economically integrated.[45] This kind of measure is not unparalleled in such conventions.[46] Indeed, the increase of the citizen body could destabilize the economic and social relations, sometimes already fragile, inside a city. The new citizens benefited from an exemption of liturgies for ten years (lines 35–37) and a series of reductions to one chalkous on different elements imposed: the products of their estates during five years, except oil (lines 18–21), their herds and beehives for three years (lines 21–23), and the products from their public and sacred land during five years (lines 28–33). After this period, they had to pay the same taxes as the Milesians, except for the grain produced in the sacred mountains of Pidasa, for which they had to pay a hundredth tax forever after the five years period (lines 33–35).

5§3 In addition to these temporary exemptions, a specific clause concerning the wine trade aimed to be maintained overtime:

(lines 39–45) συγκεχωρῆσθαι δὲ Πιδασέων τοῖς προσγραϕησομένοις || πρὸς τὸ πολίτευμα καὶ ἐνεκτημένοις ἐν τῆι Εὐρωμίδι εἰσάγειν ἀπὸ τοῦ̣ | γεινομένου οἰνικοῦ γενήματος [47] ἐν ταῖς ἰδίαις κτήσεσιν ἕως πλείστων̣ | μετρητῶν χιλίων ἀπὸ μηνὸς Ποσιδεῶνος τοῦ ἐπὶ Φιλίδου τελοῦσιν ἐλ| λιμένιον χαλκοῦν εἰς τὸν ἀεὶ χρόνον ἀπογραψαμένων ἐπὶ τὸ τῆς βουλῆς || ἀρχεῖον τῶν ἐνεκτημένων ἐν τῆι Εὐρωμίδι. κατασκευάσαι δὲ Μιλησίους || ὁδὸν ἐκ τῆς Πιδασίδος ζυγίοις πορευτὴν εὶς Ἰωνίαν πόλιν.

It should be allowed for those, among the Pidasians, who will be added to the list of citizens and who own a property in the Euromis, to import wine produced in their own estates up to a limit of one thousand metrêtai from the month of Posideon under (the stephanephorate) of Philidas, paying as ellimenion one chalkous forever, once the owners in the Euromis would have been inscribed in the Council archives. And the Milesians have to construct a road (connecting) the Pidasis to Ioniapolis, passable for the carriages”.

5§4 The Euromis correspond to the territory of Euromos, a city bordering the territory of Pidasa[48]. It was an important area for the production of wine.[49] The wine in question was probably imported to Miletus and the aim was to favor its trade.[50] The carriage road constructed between Pidasa and Ioniapolis was also likely related to this wine trade. Of course, it opened up the community of Pidasa, offering to it access to the sea.[51] But it was also the most convenient access to the port of Miletus. And the road allowed merchants to bypass the Mount Grion and to avoid the plain of Heraclea by Latmus and its taxes.[52] It was therefore a way to attract this wine in the port of Miletus and its market.[53]

5§5 The Milesians offered to the Pidasian producers of the Euromis a reduction of the ellimenion. Our sources regarding this harbor fee give little information about its nature and reveal nearly nothing about the way it was assessed. Velissaropoulos proposed three interpretations depending on the context[54]: the user fees of the harbor, charged for the use of port facilities;[55] the ad valorem tax as customs duty; the harbor taxes as a whole, including both formers. Recently, Chankowski has argued for a more precise use of the term: ta ellimenia in plural would refer to the harbor fees and customs duties in general, whereas in singular, it would refer only to the user fees of the port.[56] She applied this view to the ellimenion in the Pidasa-Miletus convention,[57] contrary to Migeotte who claims it was a flat-rate tax standing for the usual customs duty paid in Miletus.[58] Before coming to this point, we have to explain the application of the privilege, which had two restrictions. Firstly, the volume of imports concerned was limited to 1000 metrêtai of wine.[59] But the text does not say how this limit was calculated. Given its high amount, Migeotte has suggested that it referred to all the wine exported from the Euromis, for a year or a harvest. But I think this limit of 1000 metrêtai had rather to do with a limit by the producers or a shipment. By way of comparison, “Demosthenes” tells us that Phaenippus, one of the “Three Hundred” wealthiest Athenians, produced among other things “more than 1000 medimnoi of grain and more than 800 metrêtai of wine” a year.[560] Moreover, Athens honored an oil merchant who sold his shipment of 1500 metrêtai of oil during a shortage in 176/5 BCE.[61] So the limit by producer is probable.[62] The presence of this clause in the treaty shows at the very least that the Pidasian producers owning land in the Euromis were influential enough in the Pidasian community to negotiate this exemption. They may have also been numerous. The second condition was that the producers had to be inscribed on the lists of the Council archives. This list was certainly provided to the officers or farmers in charge of the collection. The goods should be precisely controlled, in order that no one else except a Pidasian producer from the Euromis could import his wine with this benefit. And it was also probably the occasion to count the quantity of wine imported in relation to the limit of 1000 metrêtai.

5§6 Now, the wine of the Euromis was coming from a foreign territory. Consequently, the producers had to pay, most likely, a customs duty at the entrance of the Pidasian-Milesian territory. If the ellimenion concerned only the harbor fee, as Chankowski claims, the benefit for the producers would have been limited. This does not seem to be consistent with the spirit and the goal of the clause. Accordingly, I would interpret this Milesian ellimenion as including the customs duty at least. This assumption could be confirmed by a second mention of this Milesian ellimenion in an earlier text concerning the integration of Cretan mercenaries to the civic community (229/8 BCE): “And the assessors have to put on sale the ellimenion, on condition that the buyers of the farm let free from tax those who import something, among those who have been admitted as citizens [— — —].”[63] Even if the nature of the ellimenion here is not clearer, it is surely linked to the action of import.

5§7 The etymology of the word ellimenion implies that it was assessed in a port, but it is impossible to know whether it was assessed in the one in Ioniapolis or the one in Miletus. The flat fee of one chalkous was probably valid for both ports. However, the wine was imported by a land road and one had to attend also some tolls or fee to be assessed at the land border of the territory. The chalkous was paid “forever” (eis ton aei khronon). This could be interpreted in two ways. Because it was levied in the port, Migeotte thinks it was paid for each shipment.[64] Indeed, the wording eis ton aei khronon is opposed to the exemptions limited in time and mentioned earlier in the text.[65] But it could also imply that the chalkous was paid only once and for all.[66] I would lean towards the second assumption, because it would have been the easiest way to manage the exemption: the producers would pay the one chalkous fee in the meantime they would be inscribed in the Council archives. The officers in charge would deliver them a proof of their payment[67] that they could subsequently present to the tax-gatherers of the customs duty at the land border or in the different ports. In this way, the chalkous would cover in the meantime the customs in the port and at the land border. The cargo would also be identifiable by its origin and its owner,[68] and maybe by its destination in order to justify the exemption.[69]

5§8 With this decision, Miletus granted a fiscal privilege to a specific category of producers, in order to attract their products on its market. This decision was permanent. The recent sympoliteia probably created the need of this exemption, but the fact remains that the city used the exemption as a tool, so as to apply its economic choice of attracting this wine.

5§9 To conclude, the documents we have examined demonstrate the various ways in which a city could use the tax exemption in a social and economic perspective. First, it could be used for recovery after a period of war, thus allowing the inhabitants to get back to normal living conditions (cf. treaty with Magnesia). Then, in the medium-term, a city could attempt to avoid the same issues in case of a new war, negotiating exemption on goods moving in secure places on a friend territory (cf. treaties with Magnesia and Heraclea). Because it was limited to a personal use, we could say that these decisions belong to a social perspective. In the same way, the exemptions could also be used to provide easier conditions for new citizens to be integrated in the community (cf. the temporary exemptions of the treaty with Pidasa). In the long-term, cities could finally negotiate tax exemptions on movements of goods to favor a specific activity (livestock in the treaty with Heraclea) or to attract a specific product on their market (wine in the treaty with Pidasa). These two decisions can be viewed as economic choices to the extent that they were intended to be permanent and to enhance a specific economic activity. This stance was not an exception; in fact, the sources provide other examples regarding the use of tax exemption as an economic tool.[70] Miletus was thus able to use its tax system both to confront temporary crises and to address long-term matters in an economic perspective.

* I would like to express my gratitude to the CHS and its staff for this opportunity to work in such great conditions this year and to present my work in this research bulletin. I would like also to thank the people who helped me to improve this paper by their advices and comments, or by correcting my English: A. Bresson, V. Chankowski, C. Chandezon, R. M. Errington, A. Chaniotis, E. M. Harris, M. Pavlou, E. Martín González and M. Goh. Of course, I am the only accountable for the remaining errors.

[1] On taxation and trade, see Bresson 2008, 72-97. On exemption as an economic leverage, see Gabrielsen 2011 who is notably arguing that exemptions were monopoly-like agreements. Other examples of economic interventions by the Greek cities in Migeotte 2006. See also Carrara 2011:459–554. I am currently working on the publication of this work, which will appear in the Éditions Ausonius (Bordeaux, France). For an overview on the tax exemption system, see Rubinstein 2009.

[2] For the bibliography on Miletus, cf. Ehrhardt, Lohmann, and Weber 2007.

[3] Wörrle 2004:47–50 and Wörrle 1988:444 on the circumstances of the catch of Myous by Miletus.

[4] Respectively, Milet I 3.148 (cf. below n14); 150 (cf. below n25); 149 (cf. below n39). For the location of Pidasa, cf. Cook 1961:91–96; Robert and Robert 1976:193–195 with pictures of the site; Chandezon 2003:226 and Figure 1 above.

[5] Wörrle 1988.

[6] Errington 1989:280–281.

[7] For sure between 185–180 BCE. This dating relies on the chronology of the stephanephoroi-list in Miletus and Heraclea, cf. Errington 1989:285–287, who does not disclaim the chronology of the Milesian stephanephoroi proposed by Wörrle. Recently, the latter has claimed to date the convention from 186–181 BCE, cf. Wörrle 2004:50.

[8] Wörrle 2004:52–57. He points out that the aim of the treaty between Miletus and Heraclea was mainly to put an end to the ongoing conflict between the two cities. According to him, there is no reason to see in this treaty the origin of the alliance against Magnesia. As a result, there is no need to assume the priority of the former over the latter. Moreover, he considers that during this period Antiochus III was more concerned with the Straits area. Consequently, compared to this more ambitious strategic aim, he could have ignored the local war in the Maeander, thus giving some space for the local Rhodian hegemony in this area. The only thing that can be said with certainty about this conflict, according to Wörrle, is that it did not last for long.

[9] Even though Wörrle’s arguments are interesting, I am following the later dating of Errington. Reconsidering the arguments of the two scholars and taking as a comparison the peace treaty between Samos and Priene negotiated with the mediation of Rhodes, Habicht places the dating of our text in the 180s BCE, cf. Habicht 2005. But the treaty between Samos and Priene has been recently dated in ca. 196–192 BCE, cf. Magnetto 2008.

[10] Gauthier 2001:122–124.

[11] Cf. already Wörrle 1988:445n92.

[12] Wörrle 2004:51.

[13] On the Rhodian supremacy, cf. Bresson 2003.

[14] Milet I 3.148. Cf. Milet VI 1, p.182–184 [German transl.] for the former bibliography; Ager 1996:no 109; Baker 2001 [French transl.]; Grieb 2008:199–201, 223–225 and passim [institutions].

[15] It was maybe located approximately four kilometers on the north of Myous, its spring was in the Latmus, cf. Robert 1959:15–19; Wörrle 2004:47–52. Miletus named this ancient territory of Myous “peraea” in the convention, because it was located “on the other side” of the Latmic gulf, cf. Herrmann 2001:113–115; Wörrle 2004:47–48. Miletus considered it as an actual peraea, cf. Chandezon 2003:230n210.

[16] Maybe the Hybandis territory mentioned in Milet I 3.33 (234/3 BCE), cf. Wörrle 2004:47–48 and n9.

[17] Return of the prisoners (lines 64–75) and amnesty for the generals who served during the war (lines 59–64).

[18] Chaniotis 2008:121. About the economic impact of war, see Chaniotis 2011. For the reasons that could lead to move goods in case of war, cf. Müller 1975:147–148 especially.

[19] This rate is known in ten different places between the fifth and the third century BCE, cf. Carrara 2011:280–292 and 773–774, table 14.

[20] Indeed, we could not exclude a flat-rate tax, even if the evidence we have for this kind of tax is rare and rather concerns the user fees of the harbor, e.g. IG I3 8.15–24.

[21] I.Magnesia 6 (lines 20–21): καὶ ἀτέλειαν πάντων ὧν ἂν [εἰσ]άγηι ἤ ἐξάγηι ἤ διάγηι εἰς τὸν ἴδιον οἶκον̣· See also I.Magnesia 9 and 11 (third century BCE).

[22] The customs are also attested in Miletus (cf. below part 4, the alliance with Heraclea) and maybe a transit tax in the third century BCE. We find a [— — — διαγ]ώ̣γ̣ι̣ο̣ν̣ (Milet I 3.33b.B15) and some παραγώγια that a king exacted in the city, maybe taxes that Miletus used to assess itself before (Milet I 3.139.5–7).

[23] Rousset 2010, 34–35 and n90; Carrara 2011:335–338 and 776–780, table 17.

[24] Carrara 2011:319–328. On this difficult matter, Chaniotis has presented a convincing hypothesis about the function that the horophylakes could have in assessing customs or tolls at the border of the territory, at least in the convention between Miletus and Heraclea (lines 86–99), cf. Chaniotis 2008:139–141.

[25] Milet I 3.150. Cf. Milet VI 1, p.185–189 [German transl.] for the former bibliography; Ager 1996:no 108; Chandezon 2003:no 58 [lines 67–77, French transl., livestock]; Migeotte 2004, passim and annex 4 [lines 34–78, French transl.]; Wörrle 2004 [dating]; Habicht 2005 [dating]; Grieb 2008:199–205, 221–225, 251–252 [institutions]; Chaniotis 2008:139–141 [lines 87–99, English transl.; horophylakes].

[26] Ager 1996:67–77; Wörrle 2004:49.

[27] Cf. lines 44–66 for the details of the application of this isopoliteia.

[28] Amnesty on complaints of war (lines 36–38), return of the fugitive slaves (lines 87–99).

[29] Chandezon 2003:211–212; Bresson 2007:197–198.

[30] Chandezon 2003:231.

[31] Cf. Figure 1 above.

[32] By the way, later in the text (lines 99–104), the agreement is dealing with the regulation of the cost of this ferryboat. The Heracleots were given the same fare as the Milesians for its use. It was probably the counterpart of the exemption of the transit tax granted to the Milesians, cf. Milet I 3, p. 239.

[33] Chandezon 2003:230–231.

[34] Baslez 1976:356 quotes our convention, without explaining, for all that, the meaning of this passage. She only explains the passage in the Miletus/Pidasa agreement (Πιδασέων τοῖς || […] ἐνεκτημένοις ἐν τῆι Εὐρωμίδι, line 39–40, cf. below).

[35] Migeotte 2004:633–4.

[36] As a parallel, cf. line 44: ὧν καὶ τοῖς ἄλλοις μέτεστι Μιλησί{ων}οις, or in the same spirit, about the ferryboat, lines 104–105: ὅσον καὶ παρὰ Μιλησίων λαμβάνουσιν.

[37] Chandezon 2003:275–286. For general elements on agricultural activities, cf. Bresson 2007:123–147.

[38] Wörrle 1988:429n20; Chandezon 2003:231.

[39] Milet I 3.149. Cf. Milet VI 1, p. 184–185 [German transl.] for the former bibliography; Gauthier 2001 [institutions]; Migeotte 2001 [lines 18–48, French transl.; financial clauses]; Chandezon 2003:no 57 [lines 18–25, French transl., livestock farming]; Migeotte 2003:304–305; Chankowski 2007; 317–318 [ellimenion]; Bresson 2007:181–182 [wine]; Funke 2007 [boarders] ; Grieb 2008:199–200, 212–213 and passim.

[40] Milet I 3 p. 231.

[41] Gauthier 2001.

[42] They kept their gods, shrines and festivals, their public land and “sacred mountains” and maybe some laws, cf. Gauthier 2001:127.

[43] Cf. above 2§2.

[44] Gauthier 2001:122–123.

[45] Migeotte 2001:134.

[46] E.g. the sympoliteia between Teos and an unknown city, cf. SEG 26.1305 (= Robert and Robert 1976).

[47] La correction γε⟨ν⟩νήματος proposée par Milet I 3 n’est pas justifiée, cf. Milet VI 1, p 184.

[48] Cf. above Figure 1.

[49] Bresson 2007:181–182. Chandezon assumes an agreement between Pidasa and Euromos to allow the Pidasians to own lands in the Euromis, cf. Chandezon 2003:228.

[50] Migeotte 2001:132–133.

[51] On the geography of Pidasa, cf. Wörrle 2003:1370 especially, on this road.

[52] Cf. above Figure 1.

[53] In his assumption of a different level of taxation between the Pidasian and the Milesian tax system, Migeotte assumes that an increase of the customs at the Pidasian border could have diverted the wine of the Euromis to another port, like Iasos.

[54] Velissaropoulos 1980:218–222, cf. n100 for the former bibliography.

[55] The Delian corpus gives us a good picture of what could be these harbor user fees: hauling of ships, charging or discharging cargos, place fee in the port… Cf. Velissaropoulos 1980:219; Prêtre 2002:115; Chankowski 2007:303–305.

[56] Chankowski 2007:313–319. Though this hypothesis is attractive, it appears too rigid and the doubt is allowed in several cases, in our text especially. I am currently writing an article on this subject, for now cf. Carrara 2011:309–317.

[57] Chankowski 2007:318.

[58] Migeotte 2001:133.

[59] A metrêtes corresponded to around 39.000 liters in the attic standard.

[60] “Demosthenes” Against Phenippos 42.20 (ca. 330 BCE): ἐπειδὰν ποιῇς σίτου μὲν μεδίμνους πλέον ἢ χιλίους, οἴνου δὲ μετρήτας ὑπὲρ ὀκτακοσίους.

[61] IG II/III3 1.5.1315.6–8: ἐν δὲ τῶι ἐπὶ Ἱππάκου ἐνιαυτῶι συνηγορακὼς ἐν τ̣[— — ca. 13 — — ἐ|λαίου] μετρητὰς χιλίους καὶ πεντακοσίους ὥστε ποιη[σάμενος — — ca. 6 — — | — — ca. 5 — —]ὴν εἰς τὸν Πόντον κτλ. cf. Bresson 2008:179–180.

[62] Bresson already argued for the limit by producer and added “[La limitation] avait pour but d’exclure des faveurs fiscales non pas même les gros, mais les très gros producteurs, ceux qui avaient de vraies fortunes en vignobles et qu’il n’était pas nécessaire d’aider particulièrement”. Cf. Bresson 2007:181–182.

[63] Milet I 3.37d.67–70: [π]ο̣ιήσασθαι | [δὲ καὶ τοὺς ἀνα]τ̣[άκτα]ς τὴν̣ π̣ρ̣ᾶ̣σιν τοῦ ἐνλιμενίου, ἐφ’ ὧιτε οἱ πρι|[άμενοι τὴν ὠνὴν ἀ]τε⟨λε⟩ῖς [ἀφήσουσ]ιν τοὺς εἰσάγοντάς τι τῶμ πολι||τογραφηθέντων — — — ].

[64] “car la somme était probablement perçue à l’arrivée des bateaux au port de Milet”, Migeotte 2001:133.

[65] Cf. above 5§2.

[66] We have the same ambiguity earlier in the text, lines 33–35: τοῦ δὲ ἐν τοῖς ἱεροῖς ὄρεσιν τοῖς περιωρισμένοις γινομένο̣[υ] | σίτου τελεῖν αὐτοὺς διελθόντων τῶν πέντε ἐτῶν ἑκατοστὴν || εἰς τὸν ἀεὶ χρόνον.

[67] The Mesopotamian sources in the Seleucid period have preserved some seals bearing the name of harbor fees, maybe a proof of payment, cf. e.g. I.Estremo Oriente 79h and 134a (second century BCE).

[68] Indeed, the privilege did not imply necessarily that the owner had to make the transport by himself.

[69] For an explanation and parallels for this practice, cf. Bresson 2000a. If the chalkous would be paid for each shipment, we could assume that, in a same way, the importer would have to prove the origin of the wine and its destination to avoid paying a fee at the land border and to pay only the chalkous in the port.

[70] Cf. n1 above.

Bibliography

N.B. Since the writing of this paper, L. Migeotte has published a synthesis (see below) concerning the finances of the Greek cities, which is very helpful.

Ager, S. L. 1996. Interstate Arbitrations in the Greek World, 337–90 B.C. Berkeley.

Albertz, R., et al., eds. 2007. Räume und Grenzen: topologische Konzepte in den antiken Kulturen des östlichen Mittelmeerraums. Munich.

Andreau, J., and V. Chankowski, eds. 2007. Vocabulaire et expressions de l’économie dans le monde antique. Bordeaux.

Baker, P. 2001. “La vallée du Méandre au IIe siècle : relations entre les cités et institutions militaires.” In Bresson and Descat 2001:61–75.

Baslez, M.-F. 1976. “Déliens et étrangers domiciliés à Délos (166–155).” REG 89:343–360.

Brélaz, C., and P. Ducrey, eds. 2008. Sécurité collective et ordre public dans les sociétés anciennes (Vandoeuvres-Genève, 2007). Geneva.

Bresson, A. 2000a. “L’attentat d’Hiéron et le commerce grec.” In Bresson 2000b:131–149.

———. 2000b. La Cité Marchande. Bordeaux.

———. 2003. “Les intérêts rhodiens en Carie à l’époque hellénistique, jusqu’en 167 av. J.-C.” In Prost 2003:169–192.

———. 2007. L’économie de la Grèce des cités I Les structures de la production. Paris.

———. 2008. L’économie de la Grèce des cités II Les espaces de l’échange. Paris.

Bresson, A., and R. Descat, eds. 2001. Les cités d’Asie Mineure Occidentale au IIe siècle a.C. Bordeaux.

Carrara, A. 2011. “La fiscalité des échanges extérieurs dans le monde grec (Égypte exclue) du VIe s. a.C. à la conquête romaine.” PhD diss., University of Bordeaux.

Chandezon, C. 2003. L’élevage en Grèce (fin Ve s.-fin Ier s. a.C.). L’apport des sources épigraphiques. Bordeaux.

Chaniotis, A. 2008. “Policing the Hellenistic Countryside: Realities and Ideologies.” In Brélaz and Ducrey 2008:103–145.

Chankowski, V. 2007. “Les catégories du vocabulaire de La fiscalité dans les cités grecques.” In Andreau and Chankowski 2007:299–333.

Cobet, J., et al., eds. 2007. Frühes Ionien. Eine Bestandsaufnahme. Mainz.

Cook, J. M. 1961. “Some Sites of the Milesian Territory.” ABSA 56:90–101.

Ehrhardt, N., et al. 2007. “Milet. Bibliographie vom Beginn der Forschungen im 19. Jahrhundert bis zum Jahre 2006.” In Cobet, et al. 2007:745–788

Errington, R. M. 1989. “The Peace Treaty between Miletus and Magnesia (I.Milet 148).” Chiron 19:279–288.

Funke, P. 2007. “Alte Grenzen Neue Grenzen. Formen Polisübergreifender Machtbildung in Klassicher und Hellenistischer Zeit.” In Albertz, et al. 2007:187–204.

Gauthier, P. 2001. “Les Pidaséens entrent en sympolitie avec les Milésiens : la procédure et les modalités institutionnelles.” In Bresson and Descat 2001:117–127.

Grieb, V. 2008. Hellenistische Demokratie: Politische Organisation und Struktur in Freien Griechischen Poleis nach Alexander dem Grossen. Stuttgart.

Habicht, C. 2005. “Datum und Umstände der Rhodischen Schlichtung zwischen Samos und Priene.” Chiron 35:137–146.

Herrmann, P. 2001. “Milet au IIe siècle a.C.” In Bresson and Descat 2001:109–116.

Magnetto, A. 2008. L’arbitrato di Rodi fra Samo e Priene. Pisa.

Migeotte, L. 2001. “Le traité entre Milet et Pidasa (Delphinion 149). Les clauses financières.” In Bresson and Descat 2001:129–135.

———. 2003. “Taxation directe en Grèce ancienne.” In Thür and Fernandez Nieto 2003:297–314. Cologne.

———. 2004. “La mobilité des étrangers en temps de paix en Grèce ancienne.” In Moatti 2004:615–648.

———. 2006. “Les interventions des cités grecques dans l’économie à la période hellénistique.” In Descat 2006:387–396.

———. 2014. Les Finances des cités grecques aux périodes classique et hellénistique. Paris.

Mitchell, L., and L. Rubinstein, eds. 2009. Greek History and Epigraphy. Essays in Honour of P. J. Rhodes. Swansea.

Moatti, C., ed. 2004. La mobilité des personnes en Méditerranée de l’Antiquité à l’époque Moderne. Procédures de contrôle et documents d’identification. Rome.

Müller, H. 1975. “Φυγῆς Ἕνεκεν.” Chiron 5:129–156.

Prêtre, C., ed. 2002. Nouveau choix d’inscriptions de Délos : Lois, Comptes et Inventaires. Athens.

Prost, F., ed. 2003. L’Orient méditerranéen, de la mort d’Alexandre aux campagnes de Pompée : Cités et royaumes à l’époque hellénistique. Toulouse.

Robert, L. 1959. “Philologie et géographie, II, Sur Pline l’Ancien, livre II : 1, Le Lac Sannaus ; 2, Hybanda ; 3, Le courrier Philonidès.” Anatolia 4:1–26.

Robert, L., and J. Robert. 1976. “Une inscription grecque de Téos en Ionie. L’union de Téos et de Kyrbissos.” JS 154–235.

Rousset, D. 2010. De Lycie en Cabalide. La convention entre les Lyciens et les Termessiens près d’Oinoanda, Fouilles de Xanthos 10. Geneva.

Thür, G., and Fr. J. Fernandez Nieto, eds. 1999. Symposion 1999. Vorträge zur Griechischen und Hellenistischen Rechtsgeschichte. Cologne.

Velissaropoulos, J. 1980. Les nauclères grecs : Recherches sur les institutions maritimes en Grèce et dans l’Orient hellénisé. Geneva.

Wörrle, M. 1988. “Inschriften aus Herakleia am Latmos I : Antiochos III., Zeuxis und Herakleia.” Chiron 18:421–470.

———. 2003. “Inschriften von Herakleia am Latmos. 3, Des Synoikismos der Latmioi mit den Pidaseis.” Chiron 33:121–143.

———. 2004. “Der Friede zwischen Milet und Magnesia : Methodische Probleme einer Communis Opinio.” Chiron 34:45–57.